Featured On:

Answer a few simple questions and get matched with an advisor for your request.

We get you the best deal from our own funds or from over 50+ Banks, Credit Unions and Lenders.

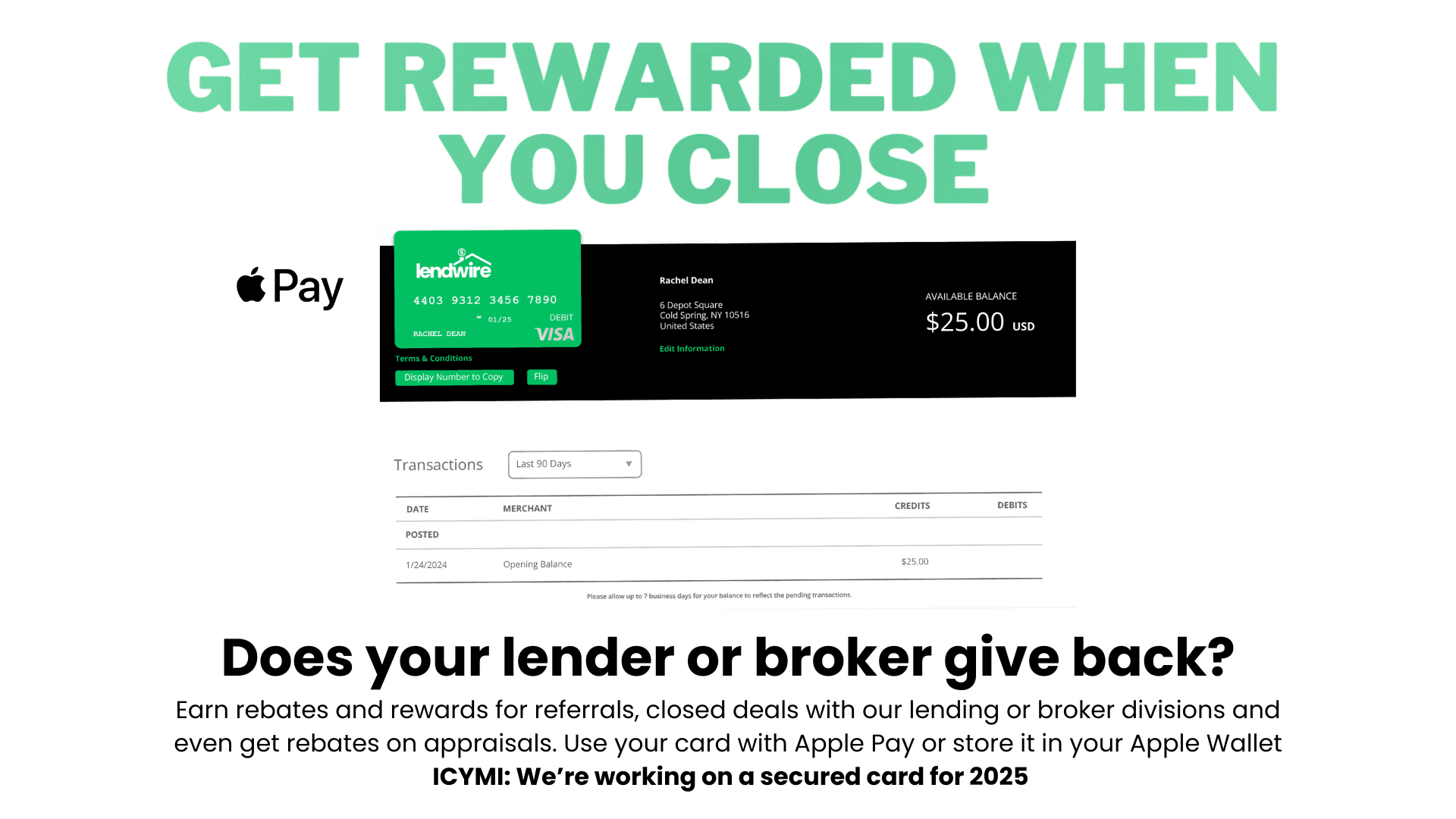

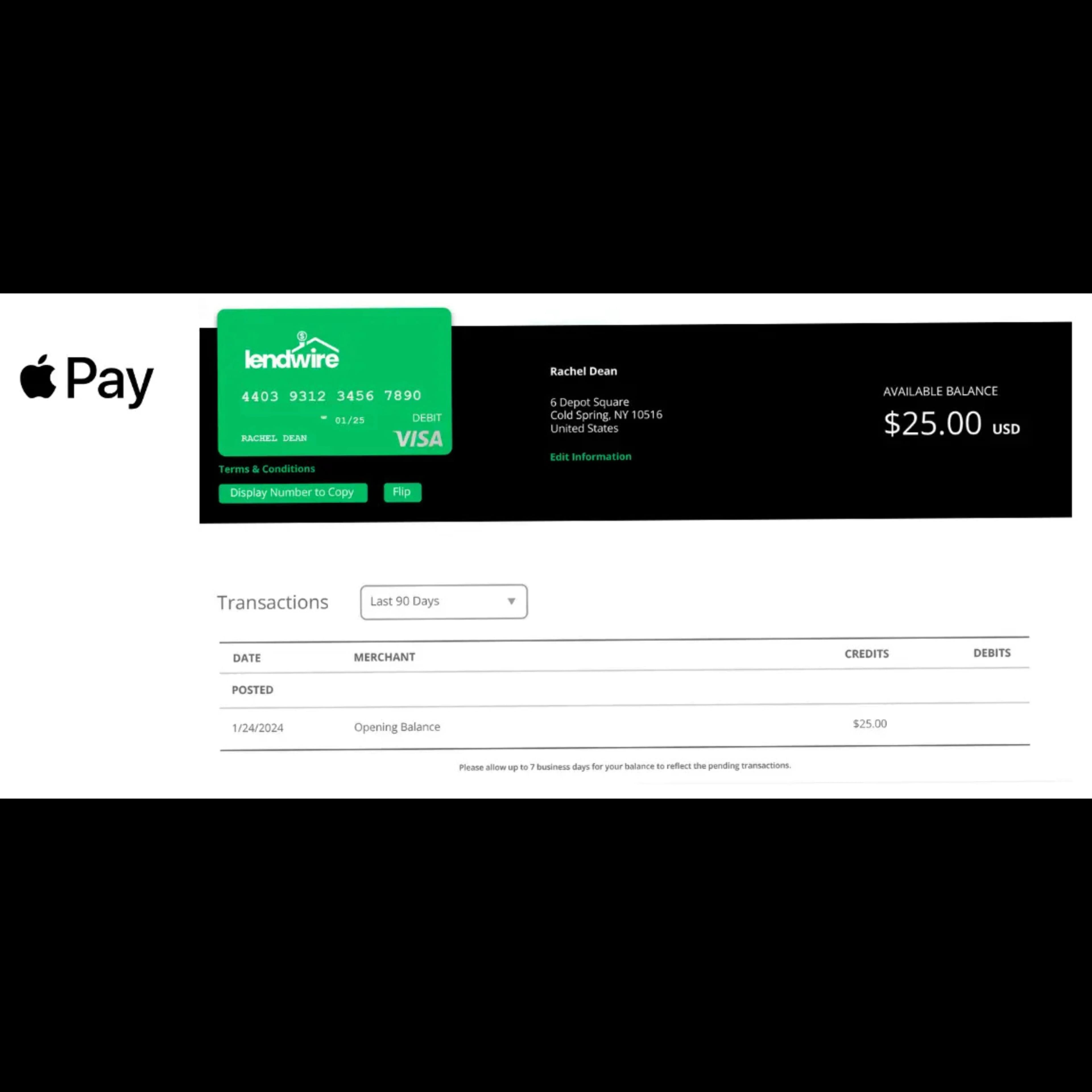

Your commitment is in - time to get funded.

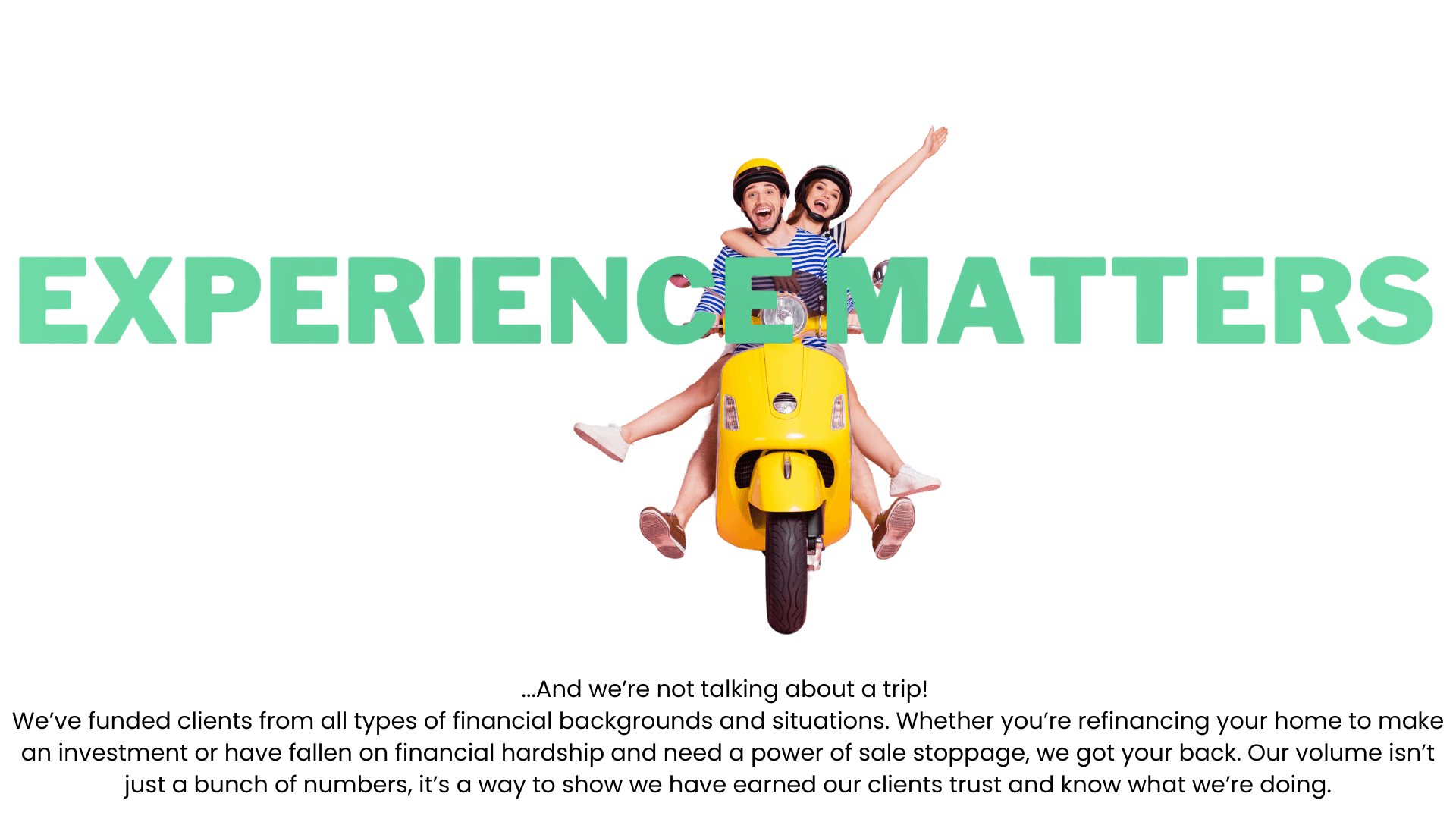

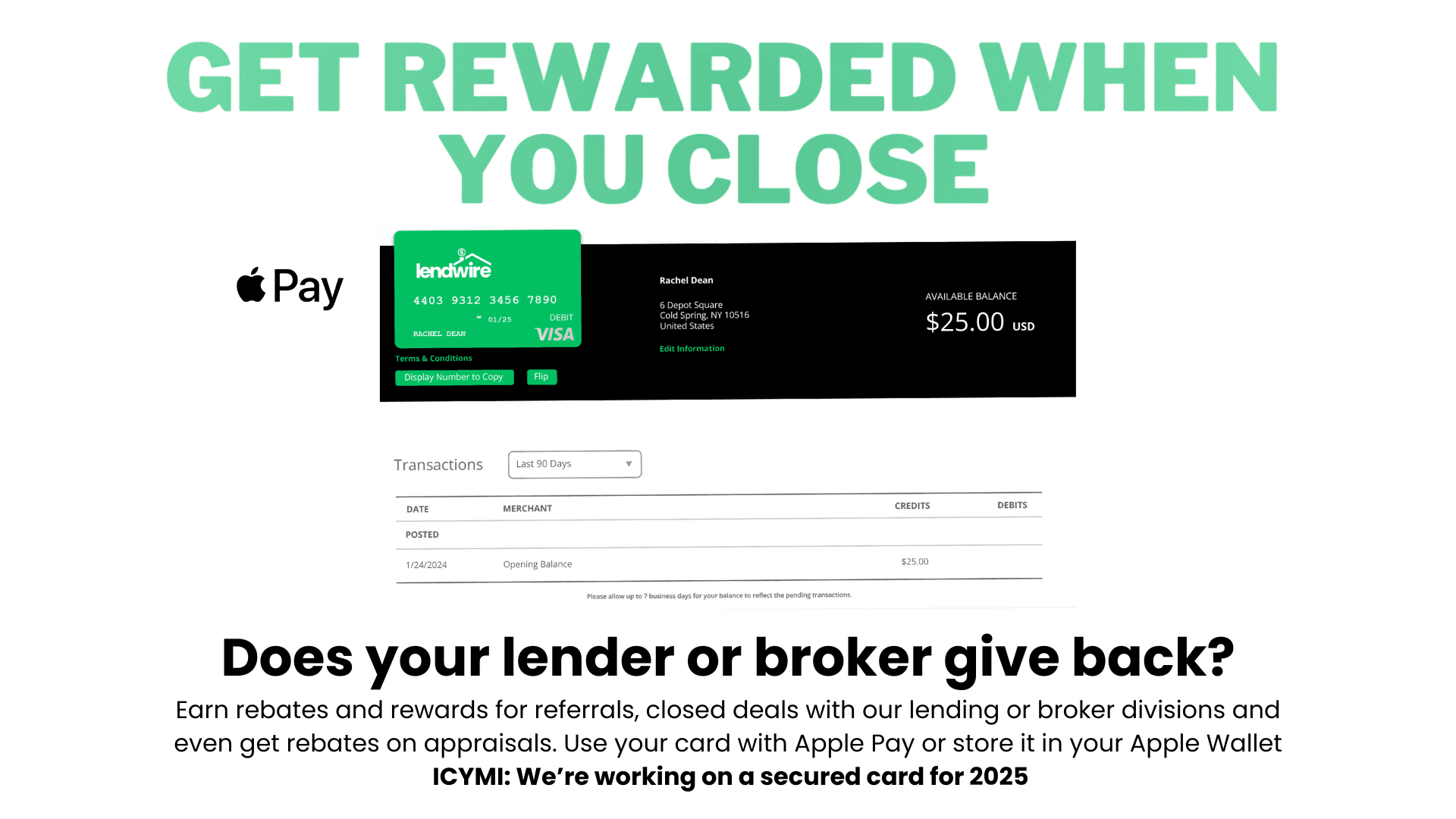

...And we're not talking about a trip!

We have funded clients from all types of financial background and situations. Whether you're financing your home to make an investment or have fallen on financial hardships and need a power of sale stoppage, we got your back. Our volume isn't just a bunch of numbers—it's a way to show we have earned our clients' trust and know what we're doing.

$ 500,000,000 +

In Mortgage Funding Paid To Our Clients So Far!

We aren’t just plugged into prime rates and products. Get approved with alternative and private options.

Every situation is unique. Alternative lending can be a valuable tool to extend your purchasing power or refinance capabilities. Private lending often facilitates debt consolidation or streamlines complex estate matters. Whether you have low credit, high debts, or are self-employed, we have you covered.